Navigate Inflation effectively is essential for businesses in an era marked by economic uncertainty. Understanding how businesses manage inflation and adapt to economic slowdowns has become crucial for sustainability and growth. Rising prices and market fluctuations pose significant challenges, but by employing effective strategies, businesses can navigate these hurdles. This article delves into the key strategies for businesses to mitigate the impacts of inflation and economic downturns, ensuring resilience and stability.

Introduction to Inflation and Economic Slowdowns

Navigate Inflation refers to the general increase in prices and the fall in the purchasing value of money. According to the Bureau of Labor Statistics, consumer prices have increased significantly, impacting everything from everyday goods to essential services. Such inflation affects consumer behavior, cost structures, and overall market dynamics. Economic slowdowns, characterized by reduced consumer spending and investment, can further exacerbate these effects, leading to decreased revenues and profitability for businesses. Therefore, understanding the impact of inflation on businesses is essential for crafting effective Navigate Inflation management strategies.

Monitoring Economic Indicators

To navigate inflation effectively, businesses must be vigilant in monitoring key economic indicators. This includes tracking inflation rates, unemployment levels, consumer confidence indices, and other economic signals. The Federal Reserve and other economic research institutions regularly publish data that can help businesses gauge the economic landscape. For instance, the Consumer Price Index (CPI) provides insights into inflation trends that can directly affect pricing strategies. By staying informed, companies can adjust their strategies proactively, allowing them to respond swiftly to emerging economic trends and consumer behaviors. The ability to interpret these indicators can mean the difference between proactive planning and reactive crisis management.

Pricing Strategies During Inflation

As Navigate Inflation drives up costs, businesses must reassess their pricing strategies. Adjusting prices is a necessary step, but it requires careful consideration to avoid alienating customers. Research indicates that consumers are more sensitive to price changes during economic downturns, which can lead to decreased sales if not handled correctly. Transparent communication about the reasons for price increases can foster customer trust and loyalty. Additionally, implementing dynamic pricing models that reflect real-time costs can help businesses remain competitive while maintaining profitability. This model can utilize algorithms to automatically adjust prices based on supply, demand, and other market factors. By strategically managing their pricing, businesses can mitigate the adverse effects of inflation on their revenue streams.

Cash Flow Management Techniques

Effective cash flow management is critical during inflationary periods. According to financial experts, businesses should focus on enhancing liquidity through various strategies, such as negotiating longer payment terms with suppliers and tightening credit policies for customers. Establishing a robust cash reserve can provide a buffer against unexpected expenses or downturns. Implementing financial forecasting tools, such as cash flow projection software, can aid in predicting future cash flows, enabling businesses to make informed decisions about expenditures and investments. In this context, keeping a close eye on accounts receivable and payable can help maintain a healthy cash flow, Navigate Inflation ensuring that businesses have the necessary funds to operate smoothly.

Inventory Management Optimization

Efficient inventory management is essential for navigating inflation. Holding excessive inventory can lead to increased costs, particularly if prices continue to rise. According to industry studies, businesses that adopt lean inventory strategies tend to outperform their competitors during economic fluctuations. Implementing just-in-time (JIT) inventory systems minimizes stock levels while ensuring that they meet customer demand. This method not only reduces holding costs but also allows businesses to be more flexible in their purchasing strategies. Additionally, leveraging data analytics to forecast demand accurately can help businesses maintain optimal inventory levels, reducing both holding costs and the risk of stockouts. Businesses can utilize tools that analyze sales trends to better predict demand and adjust their inventory accordingly.

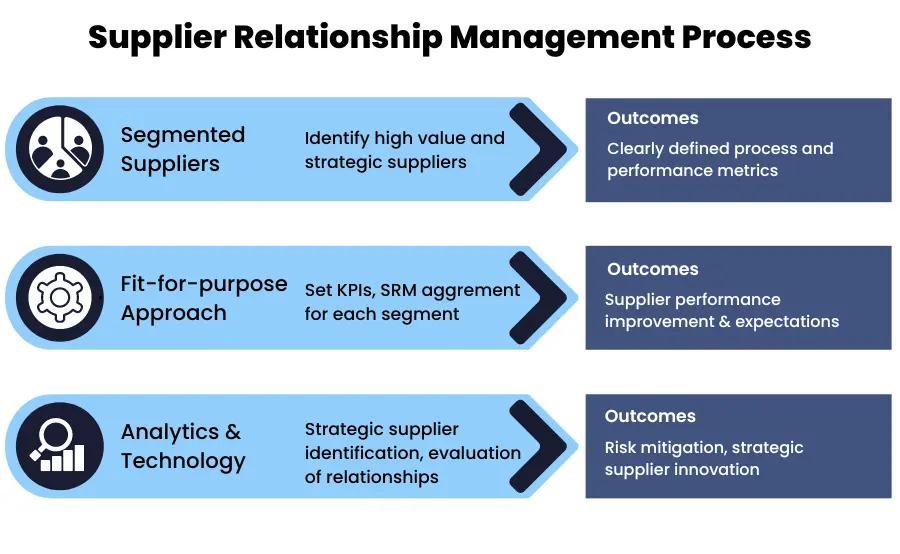

Supplier Relationship Management

Strong supplier relationships are vital in an inflationary environment. By fostering partnerships with suppliers, businesses can negotiate better terms and secure favorable pricing on materials and services. According to procurement experts, businesses that invest in supplier relationship management often experience lower costs and improved quality. Diversifying the supply chain to include multiple vendors can also mitigate risks associated with reliance on a single supplier. Navigate Inflation Building long-term relationships can result in mutual benefits, including improved service levels and stability in pricing. Companies should also consider collaborating with suppliers on inventory management to reduce costs and improve efficiency.

Technological Integration and Automation

Embracing technology and automation can significantly enhance operational efficiency, helping businesses to reduce costs during inflationary periods. Investing in data analytics tools allows businesses to gain insights into spending patterns, inventory levels, and operational inefficiencies. Automation of routine processes not only saves time but also reduces labor costs, enabling businesses to allocate resources more effectively. For instance, automated billing systems can streamline operations and ensure timely payments. By leveraging technology, businesses can streamline operations and improve their ability to respond to economic fluctuations.

Focus on Core Competencies

In times of economic uncertainty, businesses should concentrate on their core competencies. This involves evaluating and possibly eliminating non-essential functions that do not contribute to the business’s primary objectives. By focusing on strengths and areas of expertise, businesses can enhance operational efficiency and resource allocation. This strategic alignment enables businesses to weather economic challenges while continuing to deliver value to customers. Companies should conduct regular assessments of their services and products to ensure that they align with their long-term vision and goals.

Revenue Diversification Strategies

Exploring new revenue streams can help businesses mitigate risks associated with economic downturns. This might include expanding product lines, entering new markets, or offering complementary services. Research shows that businesses that diversify their revenue sources tend to be more resilient during economic downturns. By diversifying their offerings, businesses can reduce dependency on a single source of revenue and enhance their resilience against economic shocks. Innovation plays a crucial role in identifying new opportunities, allowing businesses to adapt to changing consumer demands and preferences. Regular market analysis can reveal gaps in the market that businesses can exploit for new products or services.

Inflation-Resistant Investment Options

In an inflationary environment, businesses must also consider their investment strategies. Allocating funds to inflation-protected securities, real estate, or commodities can preserve capital against the eroding effects of inflation. According to financial advisors, understanding how different asset classes respond to inflation can help businesses make informed investment decisions that align with their long-term financial goals. Additionally, businesses may consider investing in infrastructure improvements that enhance operational efficiency and reduce long-term costs.

Flexible Workforce Solutions

Adapting workforce models can significantly impact a business’s ability to Navigate Inflation and economic slowdowns. By embracing flexible work arrangements, such as remote work or contract-based positions, businesses can reduce fixed costs associated with permanent staffing. This flexibility allows businesses to scale their workforce in response to changing market conditions, enhancing overall agility and responsiveness. Companies that invest in training and development for their workforce can also improve employee engagement and productivity, leading to better outcomes during challenging economic times.

Crisis Management and Business Continuity Planning

Developing robust crisis management and business continuity plans is essential for resilience. These plans should outline procedures for responding to various economic scenarios, including inflation spikes and prolonged downturns. According to business continuity experts, regular reviews and updates of these plans ensure that businesses remain prepared to face challenges head-on. A proactive approach to crisis management can help businesses maintain operations and safeguard their reputation during turbulent times. Training employees on these plans and conducting regular drills can help ensure that everyone is prepared when a crisis arises.

Conclusion

Navigating inflation and economic slowdowns is a complex challenge for businesses. However, by employing targeted strategies such as effective cash flow management, optimized pricing, and strong supplier relationships, companies can mitigate risks and position themselves for success. Understanding how to manage inflation not only helps businesses survive but also thrive in uncertain economic climates. By focusing on core competencies, diversifying revenue streams, and leveraging technology, businesses can build resilience that lasts beyond the current economic challenges.