Blockchain technology has emerged as a transformative force in modern business, revolutionizing how companies handle transactions, data, and business operations. This article provides a deep dive into blockchain technology and its growing role in business transactions across various industries. We will explore the key features, use cases, challenges, and future trends shaping blockchain’s place in the world of business.

Introduction to Blockchain Technology in Business

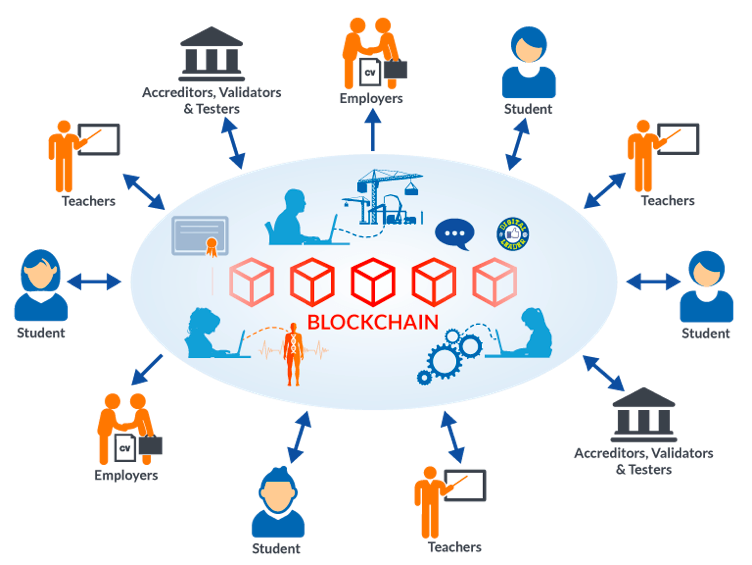

Blockchain technology is essentially a decentralized digital ledger that records transactions across a network of computers. It allows for transparent and secure data management without the need for intermediaries. Businesses today are increasingly adopting blockchain to enhance the speed, security, and accuracy of their transactions. Whether in banking, healthcare, or even entertainment, blockchain technology in business transactions is becoming indispensable.

The decentralized nature of blockchain ensures that no single entity has control over the entire network, making it highly secure. This is one of the reasons why industries, particularly those dealing with sensitive data like blockchain technology in healthcare and blockchain technology in banking, are adopting this technology.

Key Features of Blockchain Technology in Business Transactions

Blockchain offers several fundamental features that make it ideal for businesses:

- Immutability: Once information is recorded on the blockchain, it cannot be altered. This makes it highly reliable for transaction verification and preventing fraud.

- Transparency: All participants in the blockchain network have access to the same data, enhancing trust among stakeholders.

- Security: Blockchain utilizes cryptographic techniques, which make blockchain big data security a key advantage. Data is stored across decentralized nodes, making it difficult to tamper with.

Blockchain vs Traditional Business Transaction Systems

In traditional business transaction systems, third-party intermediaries such as banks or brokers are often involved in verifying and facilitating transactions. This process can be time-consuming and expensive. In contrast, blockchain technology enables peer-to-peer transactions, removing the need for intermediaries and significantly reducing transaction times and costs.

Additionally, blockchain’s decentralized nature ensures greater transparency, while traditional systems can sometimes lack visibility and accountability. This makes blockchain technology in crypto and banking a game-changer in the financial sector, with digital currencies like Bitcoin and Ethereum leading the way.

Benefits of Blockchain in Business Transactions

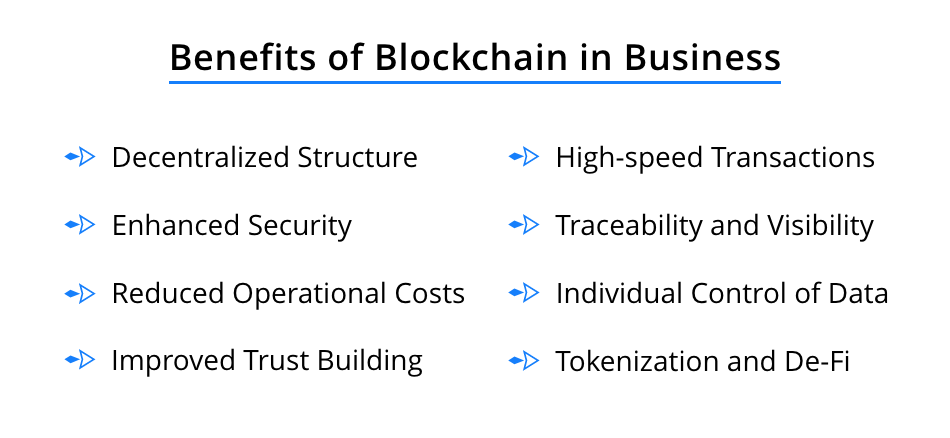

The use of blockchain technology in business offers several distinct advantages, including:

- Trust: Blockchain’s transparency ensures that all parties in a transaction have access to the same, unalterable information, fostering trust.

- Cost-efficiency: Eliminating intermediaries reduces the cost of transactions, making businesses more profitable.

- Automation: Smart contracts, which are self-executing agreements built into blockchain systems, automate processes, reducing human error and improving efficiency.

Use Cases of Blockchain in Business Transactions

Blockchain technology has a wide array of applications in business:

- Supply Chain Management: Blockchain helps track products across the supply chain in real time, increasing transparency and efficiency.

- Smart Contracts: These are self-executing contracts that automate and enforce agreements without the need for intermediaries like lawyers, reducing transaction time and costs.

- Cross-Border Payments: Traditional cross-border payments are slow and costly, but blockchain allows for fast, secure, and low-cost international transactions.

The application of blockchain technology in banking is particularly notable, as banks are utilizing blockchain for real-time payment settlements and fraud prevention.

Blockchain’s Role in the Financial Sector

One of the largest beneficiaries of blockchain has been the financial sector. Blockchain technology in crypto has enabled the rise of decentralized digital currencies, revolutionizing payment systems globally. Blockchain technology in banking is also being used to reduce the cost of remittances, enable real-time payment settlements, and improve overall transaction security.

The advent of decentralized finance (DeFi), a blockchain-based financial system, is offering new ways for individuals and businesses to manage assets without relying on traditional banking systems. This shift is particularly evident in sectors where cryptocurrencies are disrupting traditional financial models.

Challenges of Blockchain Technology in Business Transactions

While blockchain offers numerous advantages, there are still several challenges to widespread adoption:

- Scalability: The size of the blockchain grows with each transaction, and as more businesses adopt it, scalability issues may arise. This is particularly concerning for companies with high transaction volumes.

- Regulatory Uncertainty: Many regions have yet to fully regulate blockchain technology, creating a complex and sometimes contradictory legal environment.

- Integration with Existing Systems: Transitioning from traditional transaction systems to blockchain can be difficult for businesses, particularly those with older infrastructure.

These challenges must be addressed for blockchain to achieve its full potential in business transactions across industries.

Blockchain Technology in Healthcare

Blockchain technology in healthcare has shown great potential in improving data management, patient privacy, and the overall efficiency of healthcare systems. Patient records can be stored securely on the blockchain, ensuring privacy while allowing authorized parties quick and transparent access to important health data. This technology also enhances the traceability of pharmaceuticals, helping to eliminate counterfeit drugs and ensuring that patients receive legitimate products.

Smart Contracts: Automating Business Transactions

One of the most innovative applications of blockchain is smart contracts. These digital contracts automatically execute once predefined conditions are met, eliminating the need for intermediaries like lawyers or brokers. This automation ensures that agreements are honored without delay, making blockchain technology in sectors such as real estate, law, and blockchain technology in banking highly efficient.

Smart contracts are also increasingly used in healthcare blockchain technology, which facilitates secure and automated healthcare transactions between patients, providers, and insurance companies.

Blockchain in Cross-Border Transactions and Global Trade

Blockchain’s ability to facilitate cross-border transactions has enormous potential in global trade. Traditional international transactions can be slow and costly, requiring multiple intermediaries and sometimes taking days to complete. Blockchain technology eliminates these intermediaries, speeding up transactions and reducing costs. This is particularly advantageous in industries such as global shipping and logistics, where time is money.

Blockchain’s immutability and transparency make it an ideal solution for cross-border business transactions, ensuring that goods and payments are tracked and verified in real time.

Future Trends in Blockchain for Business

The future of blockchain technology in business transactions looks promising, with several key trends expected to shape its adoption:

- Integration with AI and IoT: As businesses look to automate more processes, the combination of blockchain technology, artificial intelligence (AI), and the Internet of Things (IoT) will create powerful, data-driven business solutions.

- Industry-Specific Blockchain Solutions: As blockchain technology matures, more industry-specific blockchain applications will emerge, tailored to meet the unique needs of different sectors such as blockchain technology in banking and healthcare.

- Decentralized Finance (DeFi): Decentralized finance, powered by blockchain technology, is expected to disrupt traditional financial systems further by offering more transparency, faster transactions, and lower fees.

These trends indicate that will continue to play a crucial role in the future of business transactions.

Implementing Blockchain in Business

For businesses looking to integrate blockchain technology into their operations, it’s essential to begin with a strategic plan:

- Evaluate Business Needs: Understand how blockchain can address specific challenges within your industry.

- Pilot Projects: Start small by implementing blockchain in a single area of your business, such as payment processing or supply chain tracking, before scaling up.

- Partnerships: Collaborating with blockchain experts or blockchain development firms can help ensure a smooth implementation process.

Businesses that successfully integrate blockchain into their operations will gain a competitive edge in the marketplace, reaping the benefits of improved efficiency, security, and transparency.

Conclusion

Blockchain technology is reshaping the way businesses handle transactions by offering a secure, transparent, and efficient solution. Whether it’s in blockchain technology in banking or blockchain in healthcare, blockchain is set to revolutionize business transactions. As this technology continues to evolve, businesses must stay ahead of trends like smart contracts and decentralized finance to remain competitive in the rapidly changing digital landscape.

2 thoughts on “The Role of Blockchain Technology in Business Transactions”

Comments are closed.