The Hang Seng Index (HSI) is a pivotal financial indicator representing the performance of the largest and most liquid companies on the HK Stock Exchange. Launched in 1969, the HSI serves as a benchmark for investors looking to gauge the health of the Hong Kong economy. With 50 constituent stocks that account for approximately 60% of the total market capitalization, the HSI reflects the overall market sentiment and trends, making it an essential tool for both local and international investors.

Historical Performance of the Hang Seng Index

Over the past decade, the analysis of the HSI’s performance reveals significant volatility influenced by various economic and geopolitical factors. From record highs to sharp declines, the index’s fluctuations often mirror broader trends in the Asian markets and the global economy. For instance, the index reached an all-time high in January 2018 but faced a series of challenges, including trade tensions and political unrest, which contributed to a substantial decline in 2020. Understanding these historical patterns is crucial for investors aiming to make informed decisions based on past performance.

Major Components of the Hang Seng Index

The HSI comprises 50 major companies, including renowned firms like HSBC, Tencent, and Alibaba. These companies are categorized into various sectors such as finance, technology, and consumer goods, providing a comprehensive overview of the economic landscape in Hong Kong. The representation of these sectors in the index allows investors to identify trends and shifts in the market. For example, the technology sector has seen significant growth, with companies like Tencent driving much of the index’s performance in recent years. Monitoring these components is essential for understanding the dynamics influencing the Hang Seng Index.

Recent Trends Influencing the Hang Seng Index

Recent trends affecting the HSI include global economic conditions, interest rate changes, and local political developments. The ongoing recovery from the COVID-19 pandemic has introduced new challenges and opportunities for the market. Additionally, the Hang Seng Stock Connect China initiative has facilitated easier access for foreign investors, enhancing liquidity and driving investment flows into Hong Kong’s market. As the geopolitical landscape evolves, understanding these trends becomes vital for predicting future movements of the index.

Market Sentiment and Investor Behavior

Market sentiment plays a crucial role in shaping the performance of the Hang Seng Index. Investor behavior can be significantly influenced by economic indicators, news events, and market volatility. For instance, periods of uncertainty often lead to risk aversion, causing investors to pull back from equities, which can negatively impact the index. Conversely, positive economic news or favorable policies can boost investor confidence, driving the HSI higher. By analyzing these behavioral patterns, investors can better anticipate market movements.

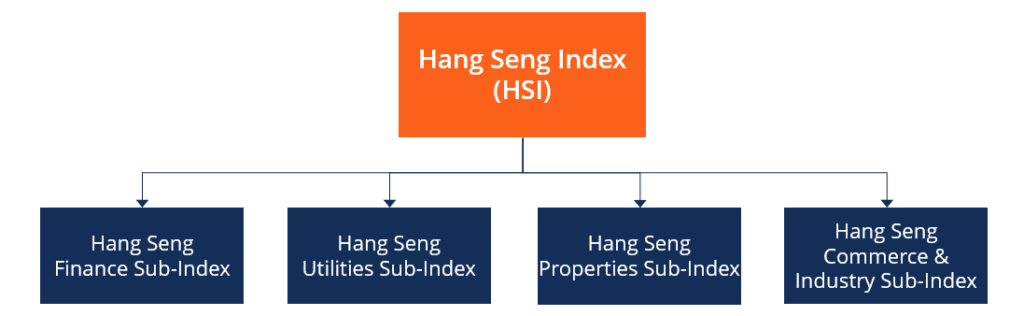

Sub-indexes of the Hang Seng Index

The HSI ESG Enhanced Index and other sub-indexes provide further insights into specific sectors and investment strategies within the HSI framework. The ESG Enhanced Index focuses on companies that prioritize environmental, social, and governance factors, appealing to socially conscious investors. Additionally, the Hang Seng Tech Index highlights the performance of technology companies, which have become increasingly important in the modern economy. These sub-indexes enable investors to target specific areas of growth while maintaining a diversified portfolio within the broader HSI.

Global Economic Factors Impacting the Hang Seng Index

Global economic factors such as trade relations, commodity prices, and currency fluctuations significantly impact the Hang Seng Index. For example, the trade relationship between China and the United States has historically influenced market sentiment in Hong Kong, leading to fluctuations in the index based on news and negotiations. Furthermore, changes in global commodity prices can affect local companies, especially those in sectors like energy and materials. Keeping an eye on these global trends is essential for investors looking to navigate the complexities of the HSI.

Regulatory Environment and Its Implications

The regulatory environment surrounding the HSI and the broader HK Stock Exchange is constantly evolving. Recent changes in regulations, particularly those related to foreign investment and data security, have implications for both local and international investors. Understanding these regulations is crucial for compliance and strategic planning. For instance, tighter regulations on technology firms may impact investor sentiment and stock performance, leading to fluctuations in the HSI. Staying informed about regulatory changes allows investors to make better decisions in a rapidly changing market.

Risks Associated with Investing in the Hang Seng Index

Investing in the Hang Seng Index is not without its risks. Market volatility, economic downturns, and geopolitical tensions can all affect the index’s performance. For instance, external shocks, such as a financial crisis or significant political unrest, can lead to sudden declines in stock prices. Additionally, sector-specific risks, particularly in finance and technology, require careful consideration. By diversifying investments and employing risk management strategies, investors can mitigate potential losses associated with these risks.

Investment Strategies Related to the Hang Seng Index

When considering investments related to the Hang Seng Index, several strategies can be employed. Passive investment strategies, such as investing in index funds that track the HSI, provide broad exposure to the market with lower fees. Conversely, active strategies may involve selecting individual stocks based on performance analysis and market trends. Moreover, leveraging the Hang Seng Stock Connect China can enhance investment opportunities by allowing access to mainland Chinese markets. Crafting a well-rounded investment strategy that aligns with individual goals is key to successful investing in the HSI.

The Future Outlook for the Hang Seng Index

Looking ahead, the future outlook for the Hang Seng Index is influenced by various factors, including economic recovery, technological advancements, and regulatory changes. Analysts predict that the HSI could see continued growth as the global economy stabilizes and domestic consumption rebounds. However, potential risks, such as inflationary pressures and geopolitical tensions, could pose challenges. Investors should remain vigilant and adaptable to navigate these uncertainties and seize growth opportunities.

Conclusion: The Hang Seng Index as an Economic Indicator

In conclusion, the Hang Seng Index serves as a vital economic indicator for Hong Kong, reflecting the health of its financial markets and the broader economy. By understanding the key trends, risks, and strategies associated with the HSI, investors can make informed decisions that align with their financial goals. As the market continues to evolve, staying informed about the HSI’s developments will remain essential for navigating the complexities of investing in the HK Stock Exchange.

This comprehensive exploration of the Hang Seng Index provides a detailed overview of its components, trends, and implications for investors. By focusing on both the historical context and future outlook, this article aims to equip readers with the knowledge necessary to make informed investment decisions in the dynamic Hong Kong market.