The video game industry is a fast-paced, constantly evolving landscape. Within this dynamic environment, Ubisoft Stock has drawn significant attention from investors and analysts. While the company faces both challenges and opportunities, the growth potential of Ubisoft hinges on various factors, from new game releases to innovative monetization strategies. This article delves into the key elements that shape Ubisoft’s business growth outlook and profit potential, providing insights for investors considering this stock.

Gaming Industry Trends

The global gaming industry has seen exponential growth in recent years, driven by technological advancements, expanding digital markets, and evolving consumer preferences. Gaming industry trends now focus heavily on live-service models, cloud gaming, and mobile platforms, areas where Ubisoft is actively investing. As the market matures, game publishers are under pressure to innovate continuously, and Ubisoft, with its rich portfolio of titles, is no exception. These trends directly affect Ubisoft’s stock as investors evaluate the company’s ability to adapt and thrive in this competitive environment.

Stock Performance Analysis

Analyzing the performance of Ubisoft stock over the past few years reveals fluctuations influenced by major game releases and corporate decisions. Despite facing some headwinds, particularly with underperforming titles like Assassin’s Creed Shadows, Ubisoft has managed to maintain a competitive standing within the industry. Key financial metrics such as price-to-earnings ratio and revenue growth remain critical for investors assessing the stock. Compared to its peers, Ubisoft’s stock is priced attractively, but the volatility requires careful monitoring of market conditions and upcoming earnings reports.

Revenue Drivers: Key Game Releases

One of the primary revenue drivers for Ubisoft has always been its blockbuster franchises. Games like Assassin’s Creed Shadows and Star Wars Outlaws play an integral role in driving sales. The success or failure of these releases can have a direct impact on Ubisoft’s stock performance. When titles underperform, such as recent delays in the Assassin’s Creed series, it places downward pressure on the stock. Conversely, strong performance of these titles can lead to stock appreciation, especially when coupled with sustained user engagement and robust pre-launch marketing.

Monetization Strategies

The gaming industry has shifted significantly from one-time purchases to recurring revenue models, with Ubisoft actively employing these monetization strategies. Through in-game purchases, downloadable content (DLC), and live-service games, Ubisoft has developed new ways to generate continuous revenue. The success of these strategies is essential for the company’s long-term growth. As digital sales increase, so does the profitability of each game, making Ubisoft’s approach to monetization strategies a critical factor for investors evaluating the company’s future profitability.

Challenges Impacting Future Sales

Despite its strong franchises, Ubisoft has faced challenges that have impacted its sales forecasts. The underperformance of titles like “Skull & Bones” and the delays surrounding “Avatar: Frontiers of Pandora” have created uncertainty for investors. Additionally, the rising competition in the gaming industry, particularly from companies launching AAA titles, adds another layer of complexity to Ubisoft’s growth outlook. Analysts have also reduced their sales forecasts for “Assassin’s Creed Shadows”, creating concerns about the company’s ability to meet revenue expectations in upcoming quarters.

Financial Health and Margins

Understanding Ubisoft’s financial health is crucial when considering its stock as an investment. The company has maintained strong gross profit margins despite missing earnings per share (EPS) estimates in recent quarters. However, Ubisoft’s aggressive cost-reduction measures are helping to improve profitability. The company is expected to generate approximately €400 million in non-IFRS operating income this fiscal year. This is supported by the company’s ability to grow its digital net bookings, which accounted for a significant portion of its revenue, further strengthening its financial position.

Forecasts and Analyst Expectations

Analyst expectations for Ubisoft stock have varied, particularly as game performance and market conditions fluctuate. Many analysts have revised their price targets for Ubisoft in response to delays and underperformance of certain titles. For instance, initial expectations for Star Wars Outlaws were high, but sales forecasts have been adjusted down from 9 million to 6 million units. Investors should watch how these revised forecasts impact the company’s stock price, as a consistent track record of missing projections could erode confidence in the stock.

Long-term Business Growth Potential

Despite some recent setbacks, Ubisoft retains a strong business growth outlook in the long term. The company’s ability to pivot toward emerging gaming technologies like cloud gaming and its potential expansion into mobile gaming platforms indicates future growth avenues. Ubisoft’s strategic focus on its core franchises, along with the development of new intellectual properties, will be crucial in driving future sales. Additionally, its ability to adapt to gaming industry trends like the increasing focus on digital distribution and in-game purchases enhances its long-term profitability prospects.

Risk Factors to Stock Appreciation

While Ubisoft stock holds potential, several risks could hinder its appreciation. Macroeconomic factors, such as economic downturns, can reduce consumer spending on video games, directly impacting sales. Moreover, the increasing competition from other major gaming companies could challenge Ubisoft’s market share. Underperforming game releases have also put pressure on the company, with recent failures like XDefiant lowering net booking estimates. These risk factors need to be carefully considered by investors who are evaluating whether the stock is a suitable long-term investment.

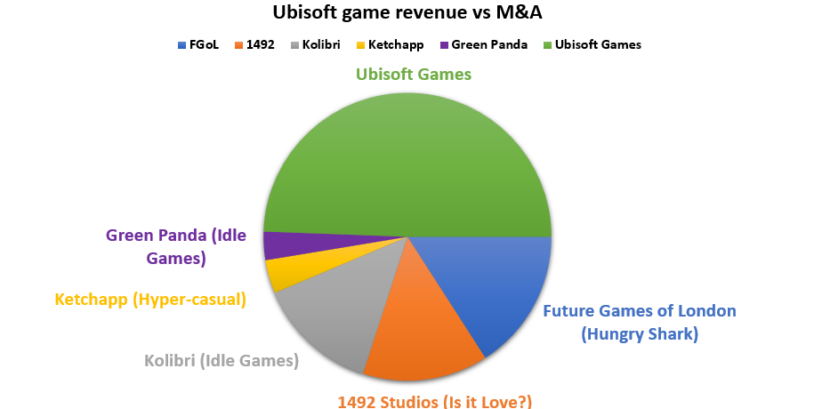

Mergers, Acquisitions, and Strategic Partnerships

Strategic partnerships and potential acquisitions could significantly influence Ubisoft’s future performance. The company has a history of engaging in partnerships with other major industry players to enhance its market presence. Future mergers or acquisitions in the gaming industry could further bolster Ubisoft’s growth trajectory, particularly if it aligns with gaming industry trends like mobile gaming or live-service models. Investors should keep a close eye on any potential announcements in this area, as such moves could lead to positive developments for Ubisoft stock.

Investor Sentiment and Market Reaction

Investor sentiment toward Ubisoft stock has fluctuated due to the company’s inconsistent performance in recent quarters. While Ubisoft has managed to maintain strong digital sales, the underperformance of some key titles has frustrated investors, leading to calls for leadership changes. Analysts suggest that Ubisoft’s upcoming earnings report could be a make-or-break moment for the stock, with investor sentiment hinging on whether the company meets or exceeds expectations. Additionally, market reactions to Assassin’s Creed Shadows and other anticipated releases will play a significant role in shaping the stock’s trajectory.

Conclusion: Balancing Risks and Opportunities

Ubisoft stock presents a complex picture for potential investors. On one hand, the company’s strong portfolio of games, combined with its innovative monetization strategies, positions it well for future growth. On the other hand, the underperformance of key titles and uncertainty surrounding future releases pose risks that should not be overlooked. Investors need to balance these risks against the company’s long-term business growth outlook. By keeping a close watch on upcoming earnings reports and game releases, investors can make informed decisions about the profit potential of Ubisoft stock.